Home PAGE

RESOURCES

- Private Investor Guide

- NPL Investor Guide

- Investment Opportunities

Main Office

- 801 Brickell Avenue

- 8th Floor

- Miami, FL 33131

- c. 305.450.6000

- w. 305.325.2100

- e. [email protected]

- id. NMLS 1281663

AN “ALTERNATIVE INVESTMENT” TO STOCKS, BONDS AND CURRENCY MARKETS

brickell capital was voted top mortgage lender by South Florida Business Journal (South Florida’s leading news outlet for residential and commercial real estate, banking, finance and business news).

Our investment objective is to seek strong risk-adjusted returns with a minimum annualized rate of return of twenty-five percent (25%) or more over the investment term (usually 6m to 24m) on the capital invested.

A non-performing loan (NPL) is a mortgage loan in which the borrower has defaulted on a schedule payment or breached the terms of the loan documents. Generally, a bank shall classify a mortgage loan that is more than 90 days past due as an NPL.

When a borrower stops making payments, the bank can initiate a foreclosure or it can sell the Loan to a private investor. When a bank has too many NPL’s on their balance sheet, it poses a cash flow and regulatory problem (i.e. mandatory reserves, banking oversight, etc.)

Banks are not set-up to efficiently service NPL’s, manage the foreclosure process, conduct property management or sell real estate owned (REO) properties. It is our goal to exploit these market inefficiencies for the benefit of our clients and investors.

Our criteria for purchasing Non-Performing Loans:

$500,000 + < 50% LTV

First-Lien Mortgage Non-Homestead Property

25% Default Interest Payment Default

Insurable (Hazard/Title) Targeted Geographical Area

We only purchase Non-Performing Loans where the underlying collateral is one of the following property types:

Single Family Residences Residential Condominiums

Luxury Townhomes Residential New Construction

Multi-Family Apt Bldgs Residential Vacant Land

brickell capital puts our client’s interests first,

because without our clients …

brickell capital would not be in business.

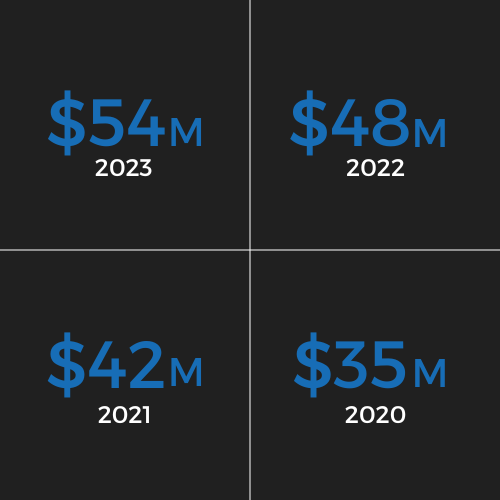

On non-performing loans, our investors net:

No excuses … we delivers results

The reason for our success:

brickell capital’s competitive advantage in achieving favorable outcomes is based on:

Brickell Capital, LLC | www.BrickellCapital.com | NMLS 1281663 | | Copyright © 2016-2024 | All Rights Reserved